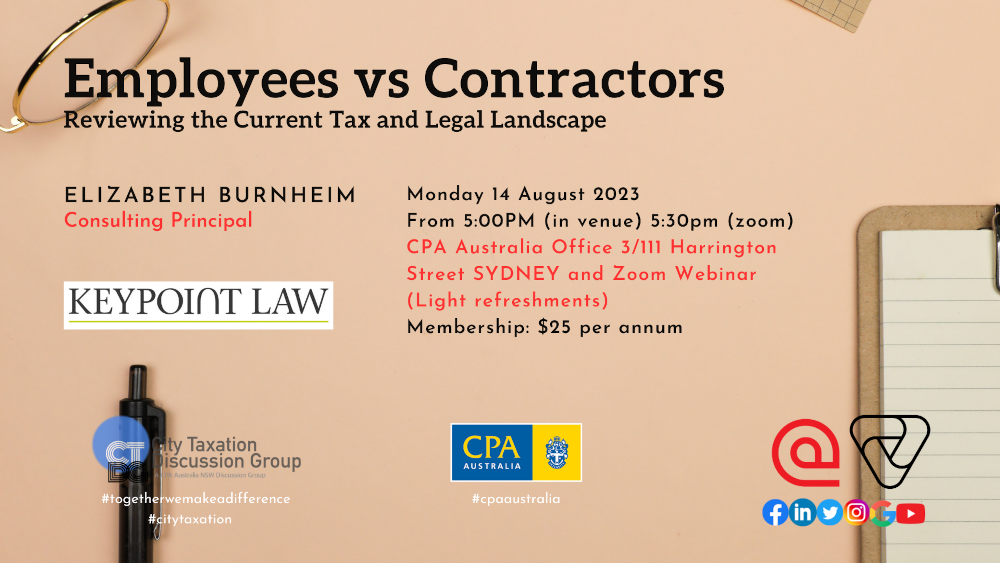

14 August 2023 | Hybrid | Employees vs Contractors | By Elizabeth Burnheim from Keypoint Law

- Description

- Curriculum

- Reviews

In Person at CPA NSW Office or Online via Zoom

We encourage our members to attend this meeting in person, a light refreshment will be provided for in person attendance. Please refer to your newsletter for the in-person registration process.

TOPIC: Employees vs Contractors: Reviewing the Current Tax and Legal Landscape

Whether an individual is an employee or independent contractor is a key commercial matter, as it can give rise to significant tax and legal implications for a business. Failure to correctly characterise a worker can result in underpayment of employment entitlements, failure to meet payroll tax, PAYG and superannuation obligations, significant penalties and reputational risk to the business and personal exposure for directors.

Company directors and officers, executives and human resource personnel should also be aware that they could be exposed to personal liability for their involvement in breaches of the Fair Work Act 2009 (Cth).

Given the current landscape, we will be hosting a timely session on the Employee versus Contractor quandary.

This session will cover:

- An overview of the legal evolution of the employees and independent contractors debate;

- What are the key factors that need to be considered when determining whether a worker is a treated as an employee or independent contractor;

- The current tax and legal landscape following recent High Court and Federal Court decisions;

- A review of recent activity by the ATO and Revenue NSW in light of these decisions;

- Income tax, superannuation and payroll tax obligations for businesses that engage contractors;

- Nuances in the employee and contractor tests for income tax, superannuation and payroll tax; and

- The importance of a written contract and whether this provides a complete solution.

Who should attend?

The webinar should be attended by:

- Anyone who engages independent contractors;

- Directors and Board Members;

- Business Owners;

- HR Professionals; and

- Any accounting or tax professional involved in advising clients about the tax classification of workers and tax implications.

SPEAKER: Elizabeth Burnheim | Consulting Principal | Keypoint Law

Elizabeth is a specialised superannuation and taxation lawyer.

She is experienced in handling complex taxation issues, often involving assisting high-net worth clients, business owners, trustees and beneficiaries of trusts, advising on business and investment structures for payroll tax purposes such as de-grouping applications and payroll tax audits.

Elizabeth often presents at internal and external seminars and various tax discussion groups around Sydney and for The Tax Institute and Legalwise. She has also written multiple articles for the Australian Shareholder’s Association monthly publication.

Continuing Professional Development Point (CPD Point)

- This event will account for up to a maximum of one (1) CPD Point per session.

- A completion certificate will be issued via LMS after the event for attendances who check in with our staff and you have attended the session for more than thirty-five (35) minutes. We are unable to issue a certificate unless we have a record of your attendance.

- Attendance records will be provided to CPA Australia, however, it is up to you to update your own CPD records/CPD Diary. We cannot update the same for you.

- You may wish to update your profile with us to include your CPA Membership number which we will report to CPA Australia accordingly.

- You should only claim for the attended hours only.

Attend via Zoom Webinar

- Our webinar will be provided via Zoom’s online Webinar platform in addition to the face-to-face meeting.

- You can listen to the webinar either via internet audio or phone dial-in. If you dial in via phone, please email us your details and phone number for attendance records.

- Zoom Webinars can be accessed on various platforms, including mobiles, tablets or laptops, etc. However, we will not be responsible for any costs incurred, such as internet charges in this regard.

- You can directly access the Zoom Webinar via our LMS, but we recommend the use of Zoom applications for a better user experience, please ensure that you only install/download the Zoom software from Zoom’s website/iOS App Store/Google App Store, DO NOT download the Zoom’s software from other sources.

- You will be automatically registered with Zoom, and you should receive Zoom’s registration confirmation email with the meeting details, no further registration is required. At the time of the meeting, simply click the link provided and the link will activate any pre-installed Zoom-related software and take you directly to the Webinar.

- Please note that we will never ask you for any password or personal information, please do not provide such information to anyone.

- To avoid last-minute technical issues, you should check if you are ready for Zoom.

- Any questions, please email us or reach us at citytaxation.com.au.

- We may not be able to resolve or attend to your needs during the webinar, but we will attempt to relay any questions to the presenter as soon as practicable.

Attend in person at CPA Australia Office

- Location: Level 3 111 Harrington Street Sydney New South Wales 2000

- Covid Safe Plan: refer to the CPA Australia Sydney Office’s COVIDSafe plans

- If you wish to obtain a zoom link just in case, please email us at [email protected].

-

114 August 2023 | Recordings1.5 hours

We note that our live Zoom webinar has been completed.

Please refer to the below recordings.

Please note that some videos may be large in file size and may cause the video player to take some time to load. We have attempted to reduce the file size as much as possible.

-

214 August 2023 | Attendance VerificationAssignmentThis lesson is locked because you haven't completed the previous one yet. Finish the previous lesson to unlock this one.

![14.04.25[85] copy](https://citytaxation.com.au/wp-content/uploads/2025/04/14.04.2585-copy-300x225.png)